Low Income Taxpayer Clinic (February 2019)

What We Do,

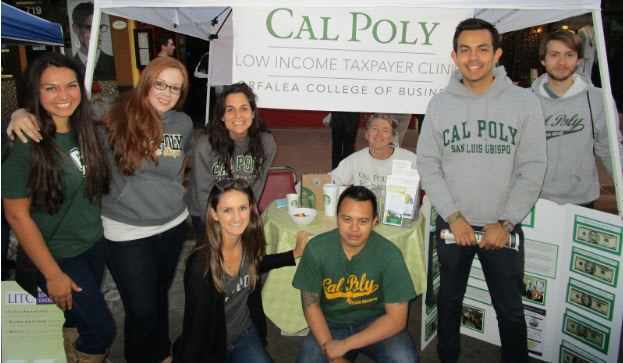

The LITC is a legal aid clinic that provides undergraduate and graduate accounting students the opportunity to work with underserved communities while enhancing their professional skills. Under the direct supervision of Orfalea College of Business faculty, students assist low-income clients involved in tax controversies before the IRS and the U.S. Tax Court. Students also provide education and outreach services on the rights and responsibilities of U.S. taxpayers to the community. The LITC provides all services in English and Spanish at no charge.

Mission Statement,

Low Income Taxpayer Clinics (LITCs) ensure the fairness and integrity of the tax system by educating low income taxpayers about their rights and responsibilities. They do this by providing pro bono representation to taxpayers in tax disputes with the IRS, by conducting outreach and education to taxpayers who speak English as a second language (ESL), and by identifying and advocating for issues that impact low income taxpayers.

Why We Need Your Help. We need your help to keep this great work going. The LITC has many expenses, from little things, like t-shirts and outreach events; to larger expenses, like trips to the tax court on behalf of our clients, and a badly needed computer upgrade. Donations will help us continue to help those less fortunate. From the bottom of our hearts, thank you for your generous donations to the LITC.

$25

Volunteer Shirts

This helps fund LITC branded shirts for up to two LITC volunteers.

$50

Volunteer Student Recognition

Help fund our volunteer student of the month recognition program.

$100

Outreach Event Support

Help fund our events, that allow us to reach those in need of tax assistance.

$250

$250 Promotional Materials

Help sponsor promotional materials such as flyers, brochures and other marketing related expenses

$500

Tax Court Trip

Support group trips to the Federal Courthouse, where we help unrepresented taxpayers with pending trials.

$1,000

Technology Upgrades

Help upgrade our computers and systems, so we are best able to assist taxpayers in need.